Mortgage Rates Are Dropping. What Does That Mean for You?

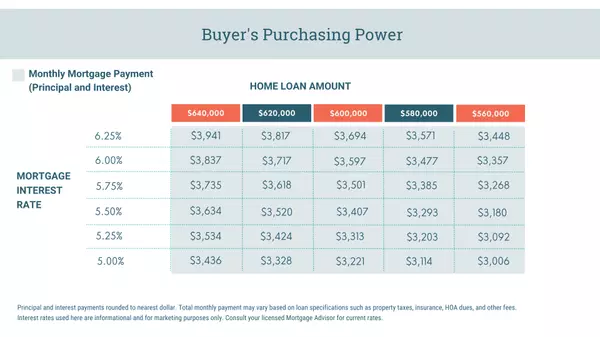

Mortgage rates have been a hot topic in the housing market over the past 12 months. Compared to the beginning of 2022, rates have risen dramatically. Now they're dropping, and that has to do with everything happening in the economy. Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), explains it well by saying: “Mortgage rates dropped even further this week as two main factors affecting today’s mortgage market became more favorable. Inflation continued to ease while the Federal Reserve switched to a smaller interest rate hike. As a result, according to Freddie Mac, the 30-year fixed mortgage rate fell to 6.31% from 6.33% the previous week.” So, what does that mean for your homeownership plans? As mortgage rates fluctuate, they impact your purcahsing power by influencing the cost of buying a home. Even a small dip can help boost your purchasing power. Here's how it works. So, let's assume you want to buy a $600,000 home in Northern Virginia. If you're trying to shop at that price point and keep your monthly payment at about $3,500 - $3,600 or below, here's how your purchasing power can change as mortgage rates shift (see chart below). This goes to show, even a small quarter-point can change in mortgage rates can impact your monthly mortgage payment. That's why it's important to work with a trusted real estate professional who follows what the experts are projecting for mortgage rates for the days, months, and year ahead. Bottom Line Mortgage rates are likely to fluctuate depending on what happens with inflation moving forward, but they have dropped slightly in recent weeks. If a 7% rate was too high for you, it may be time to contact a lender to see if the current rate is more in line with your goal for a monthly housing expense.

Listing With Kids? Keep Reading...

Home sellers can’t control the market, but they CAN control how their home is presented to it.Giving yourself ample time to prepare and anticipating where the pain points might be throughout the process for you and your family is often two major factors that impact a sellers stress levels.Making sure that the home can be comfortably shown is one way that you can maximize the exposure your home receives. If you have restricted showing hours or if you are there when the buyers are touring the property can really reduce the amount of foot traffic you get, along with how thorough of a showing a prospective buyer will do. If anyone is there or if the situation feels uncomfortable, buyers will get a negative feel, rush through and cross your home off the list.Make sure the house is clean, blinds are open and lights are on. And please. Please. Please. No sleeping people in basements (yes…we've seen it happen 🫣). Connect with us and we'll send you our 6-Month Seller Checklist to help you jumpstart the listing process!

Key Advantages of Buying a Home Today

There’s no doubt buying a home today is different than it was over the past couple ofyears, and the shift in the market has led to advantages for buyers today. Right now,there are specific reasons that make this housing market attractive for those who’vethought about buying but have sidelined their search due to rising mortgage rates. Buying a home in any market is a personal decision, and the best way to make thatdecision is to educate yourself on the facts, not following sensationalized headlinesin the news today. The reality is, headlines do more to terrify people thinking aboutbuying a home than they do to clarify what’s actually going on with real estate.Here are three reasons you should consider buying a home today. 1. More homes are for sale right now Believe it or not, the supply of homes has grown significantly this year. Thisgrowth has happened for two reasons: homeowners listing their homes for sale andhomes staying on the market a bit longer as buyer demand has moderated inresponse to higher mortgage rates. The good news for you is that more inventorymeans more homes to choose from! 2. Home prices are not projected to crash Experts don’t believe home prices will crash like they did in 2008. Instead,home prices will moderate at various levels depending on the local market andfactors like supply and demand. The expectation is for relatively flat or neutral priceappreciation in 2023. 3. Mortgage rates have risen, but they will come down While mortgage rates have risen dramatically this year, the rapid increaseswe’ve seen have moderated in recent weeks. Where they’ll go from here largelydepends on what happens next with inflation. If inflation does truly begin to cool,mortgage rates may come down as a result. This could mean more buyercompetition if many decide it’s time to jump back into the market. Your advantage isgetting in before they do. Bottom Line The bottom line is if you’re thinking about buying a home, you should seriouslyconsider the advantages today’s market offers. Let’s connect so you can make thedream of homeownership a reality!

Categories

Recent Posts